ARTICLES

Follow Us

Be the first to know

From Blueprint to Bottom Line: Engineering Due Diligence for Aerospace Acquisitions

By:

Arman M Nazari

President,

Global Technical Resources | Aerospace & Defense SME

Introduction

The aerospace sector has long captivated investors, promising cutting-edge technology, rapid growth, and the allure of transforming how the world moves. Yet beneath the polished renderings, confident forecasts, and billion-dollar projections lies a brutal, unforgiving reality: aerospace is among the most technically challenging and capital-intensive industries on earth. Engineering missteps, supply chain fragility, regulatory complexity, and underappreciated operational costs have destroyed more capital than many other sectors combined. For investors, rigorous engineering due diligence isn’t just a best practice, it is the frontline defense against programs that promise the sky but never leave the ground.

In this comprehensive guide, we examine how robust engineering due diligence can reveal the gap between glossy pitch decks and the harsh economic realities of aerospace development. We explore historical examples of programs that failed or nearly failed, dissect certification and regulatory hurdles, analyze break-even economics, and provide a toolkit for investors seeking to avoid costly pitfalls.

Historical Lessons in Aerospace Failures

The industry is littered with well-funded ventures that collapsed under the weight of engineering and certification realities. Consider the Eclipse 500, a program that attracted over $1 billion in capital and was hailed as the future of affordable light jets. Despite years of development, multiple ownership changes, and massive cost overruns, the company ultimately went bankrupt, leaving investors with substantial losses.

Or the Bombardier CSeries, which aimed to revolutionize the narrow-body market. Despite strong engineering pedigree, unforeseen certification delays, supplier issues, and production ramp-up difficulties pushed costs nearly $2 billion over budget. Ultimately, Bombardier divested the program to Airbus at a steep discount, illustrating that even technically sound programs face crushing economic pressures.

Then there’s the Boeing 787 Dreamliner, which despite its eventual success, ran billions over budget due to challenges with composite structures, global supply chain integration, and certification issues. Boeing was forced to inject massive internal capital to keep the program alive, delaying profitability by years.

Certification Complexities Across Regulatory Regimes

One of the most underestimated areas by investors is the certification landscape. In the U.S., FAA Part 23 governs smaller aircraft, while Part 25 covers large transport category airplanes. Part 27 and Part 29 govern rotorcraft. Each regulatory category has unique requirements, test protocols, and safety standards.

Typical certification costs range from tens of millions for simple Part 23 programs to several billion dollars for Part 25 programs. Even seemingly minor technical changes can trigger new rounds of testing, documentation, and regulatory scrutiny, extending timelines by years and adding millions to cost projections.

Outside the U.S., regims like EASA (Europe) and CAAC (China) introduce additional complexities, requiring potential dual certification or validation processes. Investors who fail to build certification slippage into models often face the shock of ballooning timelines and evaporating cash reserves.

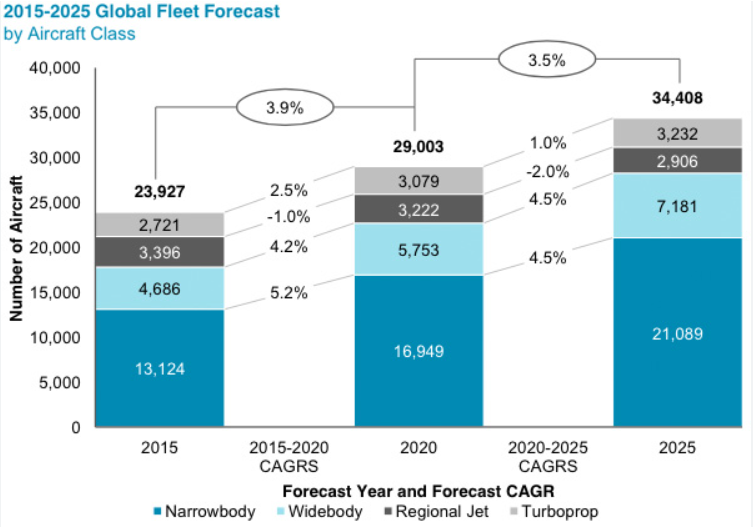

Break-even Economics: Manufacturer and Operator Perspectives

Every aerospace program must grapple with the harsh reality of break-even economics. For manufacturers, the upfront burden of R&D, tooling, and certification means hundreds of units must be delivered to recover investment. In large Part 25 programs, break-even often doesn’t occur until 400–600 deliveries.

For operators, the story is similarly unforgiving. Aircraft acquisition, pilot training, maintenance, insurance, spare parts provisioning, and periodic heavy inspections drive up costs. Historically, operators need 1,500–2,500 flight hours per airframe, or more, before the aircraft moves from loss to profit.

Any delay in certification or underperformance in early service life further delays this break-even point, compounding investor risk.

The Rise of Digital Engineering, Promise and Pitfalls

Modern programs increasingly tout digital twin, advanced simulation, and virtual testing as solutions to historical cost overruns and delays. While these tools are powerful, they are not panaceas. The 787 program famously adopted distributed global engineering and advanced digital design, yet still faced enormous challenges with real-world composite manufacturing, supplier quality variation, and final assembly integration.

Due diligence must look past digital promises and validate actual manufacturing readiness, tool robustness, and supplier audit results.

Supply Chain Realities and Ramp-up Bottlenecks

No aircraft program succeeds alone. Tier 1 and Tier 2 suppliers, subcomponent vendors, and even raw material providers are critical links in the chain. Yet history shows how fragile this ecosystem can be.

In the 787 program, multiple Tier 1 suppliers were unable to meet quality standards or ramp up fast enough, forcing Boeing to bring work back in-house at enormous cost. The Bombardier CSeries saw similar supplier bottlenecks with fuselage sections and avionics integration.

Investors should demand detailed supplier audits, contingency plans, and thorough assessments of vendor financial health.

Macroeconomic and Geopolitical Factors

Aerospace programs typically span 7–12 years from early design to stable production, a timeframe that can encompass entire business cycles. Interest rate shifts, currency fluctuations, trade wars, or geopolitical instability can dramatically alter demand forecasts, supplier viability, and capital costs.

Programs that fail to plan for these macro shocks often find themselves forced to accept unfavorable financing terms, dilute equity, or halt progress entirely.

Military vs. Commercial Lessons

While the military sector often seems attractive due to perceived government backing, history shows even defense programs suffer from massive cost overruns and technical challenges. The F-35 Joint Strike Fighter program, for instance, has seen costs balloon to over $400 billion, with decades-long development timelines.

Lessons from the military sector: stable funding does not guarantee smooth execution, and technical complexity multiplies cost risk exponentially.

Workforce and Labor Challenges

Aerospace is talent-driven. Skilled engineers, technicians, and inspectors are finite resources. Labor strikes, retention challenges, and demographic shifts in the skilled trades can derail program ramp-ups and degrade quality.

Investors should scrutinize workforce plans, examine union relationships, and assess demographic risk in key skill pools.

Financial Structuring and Investor Exit Strategies

Given the scale of aerospace investment, structuring equity tranches, debt facilities, milestone-based draws, and risk-sharing partnerships with suppliers can be essential to surviving inevitable timeline shifts.

Successful investors often build layered exit strategies, allowing partial liquidity during prototype rollout, certification milestones, or initial fleet deliveries.

Investor Toolkit: A Phased Due Diligence Approach

Investors should adopt a layered approach:

- Early phase, Verify high-level technical feasibility, IP ownership, and engineering team credentials.

- Mid phase, Audit detailed program plans, supplier readiness, and certification roadmaps.

- Late phase, Validate flight test data, production quality metrics, and customer support network maturity.

- Post-investment phase, implement milestone-linked funding draws and periodic third-party audits.

Conclusion

The aerospace industry offers massive opportunities, but only for those who do their homework. Engineering due diligence is the cornerstone of any aerospace acquisition strategy.

At GTR, we combine decades of aerospace program experience, deep engineering knowledge, and financial acumen to help investors separate hype from reality. Contact us to ensure your capital takes flight on schedule, and lands on solid ground.