ARTICLES

Follow Us

Be the first to know

The MRO Opportunity in a Fragmented Global Supply Chain: A Post-COVID Assessment for Military Operators

By:

Arman M Nazari

President,

Global Technical Resources | Aerospace & Defense SME

Pandemic Shock and Revenue Collapse

The COVID‑19 pandemic inflicted a seismic shock on the global aerospace MRO sector. Revenues dropped by approximately 35%, according to analysts , with some segments experiencing declines of nearly 45% in 2020 (aeroequity). Aircraft production also slowed dramatically: Boeing and Airbus combined orders plunged from nearly 1,922 in 2018 to just 567 in 2020, starving MRO pipelines of new work. The unprecedented downturn translated quickly into volatility: defense‑industry stock indices spiked over 50% compared to pre‑pandemic norms, underlining the fragility of traditional MRO models.

Fleet Groundings and Service Disruptions

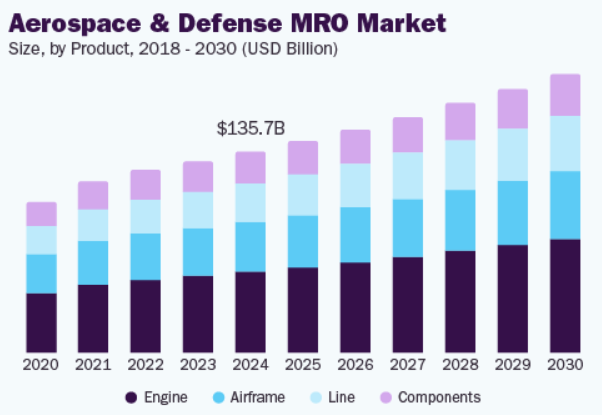

Passenger capacity contracted by over 90% in April 2020 compared to 2019 levels grounding more than two‑thirds of the global fleet. This ripple effect delayed depot cycles and deferred critical engine and airframe overhauls. For instance, engine repair spending fell from $43.5 billion pre‑COVID to just $23.2 billion post‑pandemic (satair). With traditional support structures unprepared for such rapid demand collapse, military operators found themselves competing for priority access to constrained repair slots.

Parts Availability: A Persistent Challenge

This disruption triggered acute supply chain issues, particularly in parts availability. A 2021 Oliver Wyman survey reported that over 70% of military fleet managers ranked parts shortages as their top concern, a trend that remained stubbornly high through 2023 (OliverWyman). This was not because of new aircraft production needs, but rather because existing aging fleets still required steady supplies of replacement parts and repairs. At the same time, suppliers faced workforce reductions, shutdowns, and logistics bottlenecks, which constrained the flow of critical components and repair kits. Graphs from the Aerospace Industries Association confirm procurement backlogs across rotorcraft and fighter programs. Aging fleets, supply chain fragmentation, and geopolitical realignments have become the new normal. GE Aerospace executives have since warned that supply chain bottlenecks are expected to persist well into 2024, further hampering turnaround times at critical engine repair shops (reuters). The bottom line: these aren’t hypothetical risks, they’re current operational pain points.

Here, geopolitical realignments refer to the shifting alliances, trade policies, and regional security arrangements that affect where and how parts are sourced, which countries can be relied upon for critical supplies, and how political tensions disrupt global logistics. For example, rising tensions between major powers, new export controls, and regionalization of supply chains, all force military operators to reconsider their MRO dependencies and sourcing strategies

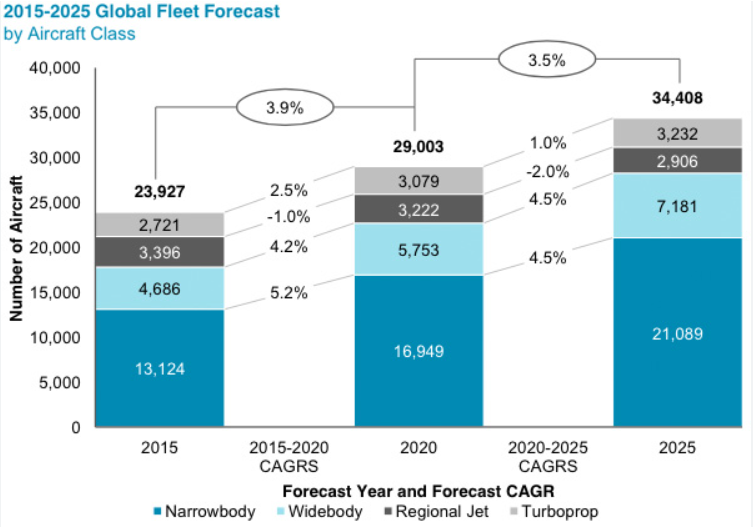

Fleet Aging and Forecasted MRO Surge

Amid supply turbulence, the global fleet is cohorted in place: commercial aircraft average age rose from 12.1 years in 2024 to 13.4 years in 2025 . Oliver Wyman forecasts that MRO demand will hit $119 billion by 2025, 12% above 2019’s peak, and climb further to $125 billion by 2033. Military fleets mirror this trend: their size is projected to grow from 45,400 active aircraft in early 2025 by 1.4% annually through 2035. With more advanced systems in play, MRO costs will escalate accordingly.

Complexity Equals Cost

Advanced platforms, such as F‑35s, UAVs, A400M transporters, and NH90 helicopters, are significantly driving up repair and sustainment costs. Oliver Wyman reports that complex aircraft spending already accounts for 11% of military MRO budgets, rising to an anticipated 17% by 2035. NATO members besides the U.S. allocate roughly 16% of their MRO dollars to these systems today, with projections toward 26% over the next decade. The F‑35 alone is set to represent nearly 10% of global military MRO costs by 2035, with lifecycle sustainment expenses up 44% from 2018 to 2023 even as flight hours declined.

Geopolitics, Fragmentation, and Strategic Risk

Geopolitical realignment, characterized by regional supply chains and trade shifts, has made fragmentation permanent. IATA/McKinsey data shows that airline traffic dropped 66% in 2020 and 58% in 2021, causing cumulative revenue losses nearing $390 billion across the value chain (iata). Meanwhile, GE Aerospace continues to dispatch 500 engineers to supplier sites and deploy AI tools, trying to offset bottlenecks (reuters). Such efforts underline that tech investments alone won't fix systemic fragility; structural redesigns- how parts are sourced, where repairs happen, etc.- are needed.

Opportunity and Strategic Imperative

These trends define a strategic inflection point: fragmentation, aging fleets, cost pressures, and stock uncertainties make MRO transformation a necessity, not a choice. Oliver Wyman forecasts MRO growth of 1.8–2.9% CAGR* through the next decade . That growth creates openings for new, flexible models, local depots, private‑public partnerships, rapid supplier qualification pathways, and predictive logistics engines. Organizations that adopt such approaches will sustain mission readiness and fiscal discipline.

Ultimately, the story is quantified, and compelling. If your government, PE firm, or privatization project is evaluating how to restructure MRO for resilience and efficiency, GTR brings a data‑driven, geopolitically aware, technically grounded consulting framework. Reach out to explore how we can model and execute your NextGen MRO strategy in today's fragmented world.

*CAGR stands for Compound Annual Growth Rate. It measures the average annual growth rate of investment, market, or metric over a specified period, assuming the growth was steady and compounded annually.

CAGR = [(Vₙ / V₀)^(1/n)] - 1

where:

- V₀ = initial value

- Vₙ = final value after n years

- n = number of years

Consultancy.uk

Grandview Research